Impermanent Loss Explained: The Math Behind DeFi's Hidden Risk

Understanding impermanent loss is crucial for anyone participating in decentralized finance (DeFi). This often-misunderstood risk can turn a profitable-looking venture into a net loss for a liquidity provider. In this guide, we break down the exact impermanent loss formula, show you how to calculate it, and provide actionable strategies to minimize its impact.

TL;DR: Impermanent Loss in DeFi

- Impermanent loss (IL) is the opportunity cost when providing liquidity to AMMs, your position may underperform simply holding the tokens (HODLing) if prices diverge.

- Formula: For a 50/50 pool, IL = 2√d/(1+d) - 1, where d = price ratio change. A 2x price move = 5.7% loss vs. HODL.

- Why it happens: Arbitrageurs rebalance pools, leaving LPs with more of the depreciating asset.

- Modern AMMs: Concentrated liquidity (Uniswap v3) increases capital efficiency but can amplify IL risk.

- Mitigation: Use stable pairs, wider ranges, or options-based hedging. Always compare expected fees to potential IL.

1. What is Impermanent Loss?

Impermanent loss is one of the most misunderstood concepts in decentralized finance (DeFi). It's not a direct loss of your tokens, but rather an opportunity cost (the difference between the value of your liquidity position and what you would have if you had simply held your assets).

Note: The term "impermanent" is misleading. The loss only reverses if prices return to their original ratio before you withdraw. In most cases, especially in volatile markets, the loss becomes permanent (realized) when you exit at a new price ratio. Think of it as an unrealized loss until you withdraw.

The Core Problem

When you provide liquidity to an Automated Market Maker (AMM) like Uniswap, you're essentially becoming a market maker. Your capital facilitates trades between two assets, and you earn fees for this service. However, there's a hidden cost: impermanent loss.

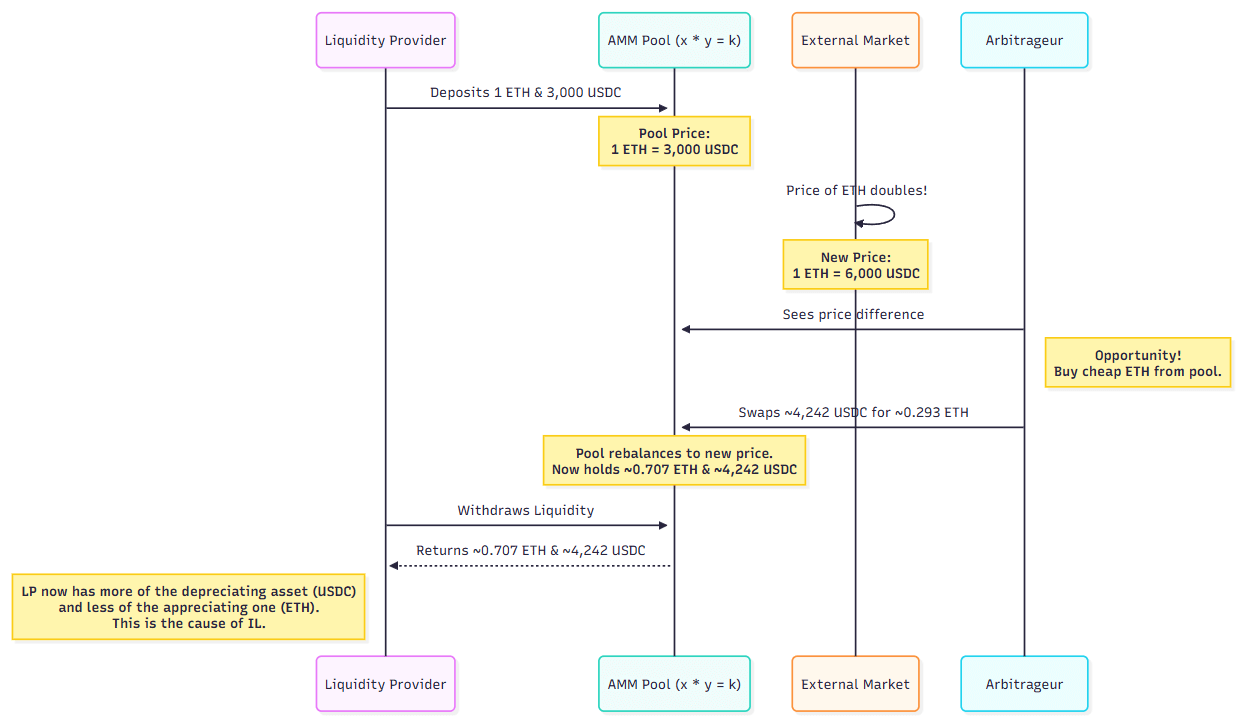

Why Does Impermanent Loss Happen?

Impermanent loss occurs due to arbitrage. Here's how:

- Price Divergence: External market prices change while your AMM pool's internal price lags

- Arbitrage Opportunity: Traders spot the price difference and buy the "cheap" asset from your pool

- Pool Rebalancing: This trading pushes the pool's price toward the external market price

- Your Loss: You end up with more of the depreciating asset and less of the appreciating one

Example: You deposit 1 ETH ($3,000) and 3,000 USDC into a pool. If ETH rises to $4,000 externally, arbitrageurs will buy ETH from your pool until it matches $4,000. You'll have less ETH and more USDC than if you had just held both assets.

Figure: Arbitrageurs rebalance pools, leading to impermanent loss for LPs.

Figure: Arbitrageurs rebalance pools, leading to impermanent loss for LPs.

2. How is Impermanent Loss Calculated? The Formula Explained

The Constant Product Formula

AMMs like Uniswap v2 use the constant product formula: x × y = k

Where:

x= quantity of Token Ay= quantity of Token Bk= constant product (invariant)

This formula ensures that the product of the two token quantities remains constant before and after any trade.

Deriving the Impermanent Loss Formula

The impermanent loss formula can be derived from first principles:

Step 1: Define Initial State

- Initial quantities:

x₀,y₀ - Initial price ratio:

p₀ = x₀/y₀ - Invariant:

k = x₀ × y₀

Step 2: After Price Change

- New price ratio:

p₁ - New quantities:

x₁,y₁ - Still:

k = x₁ × y₁andp₁ = x₁/y₁

Step 3: Solve for New Quantities From the equations above:

x₁ = √(k/p₁)y₁ = √(k × p₁)

Step 4: Calculate Values

- LP Position Value:

Value_LP = y₁ + (x₁ × p₁) = 2√(k × p₁) - HODL Value:

Value_HODL = y₀ + (x₀ × p₁)

Step 5: Impermanent Loss

IL = (Value_LP / Value_HODL) - 1- After simplification:

IL = 2√d/(1+d) - 1

Where d = p₁/p₀ (the price ratio change)

The Final Formula

Impermanent Loss = 2√(price_ratio) / (1 + price_ratio) - 1

This elegant result shows that IL depends only on the magnitude of price change, not the direction.

3. Impermanent Loss Examples: Seeing the Impact

| Price Change | Price Ratio (d) | Impermanent Loss |

|---|---|---|

| +25% | 1.25x | -0.6% |

| +50% | 1.50x | -2.0% |

| +100% | 2.00x | -5.7% |

| +200% | 3.00x | -13.4% |

| +400% | 5.00x | -25.5% |

Key Insights:

- Symmetry: A 2x price increase causes the same IL as a 0.5x decrease (5.7%)

- Non-linear: IL accelerates with larger price movements

- Direction doesn't matter: You lose whether prices go up or down

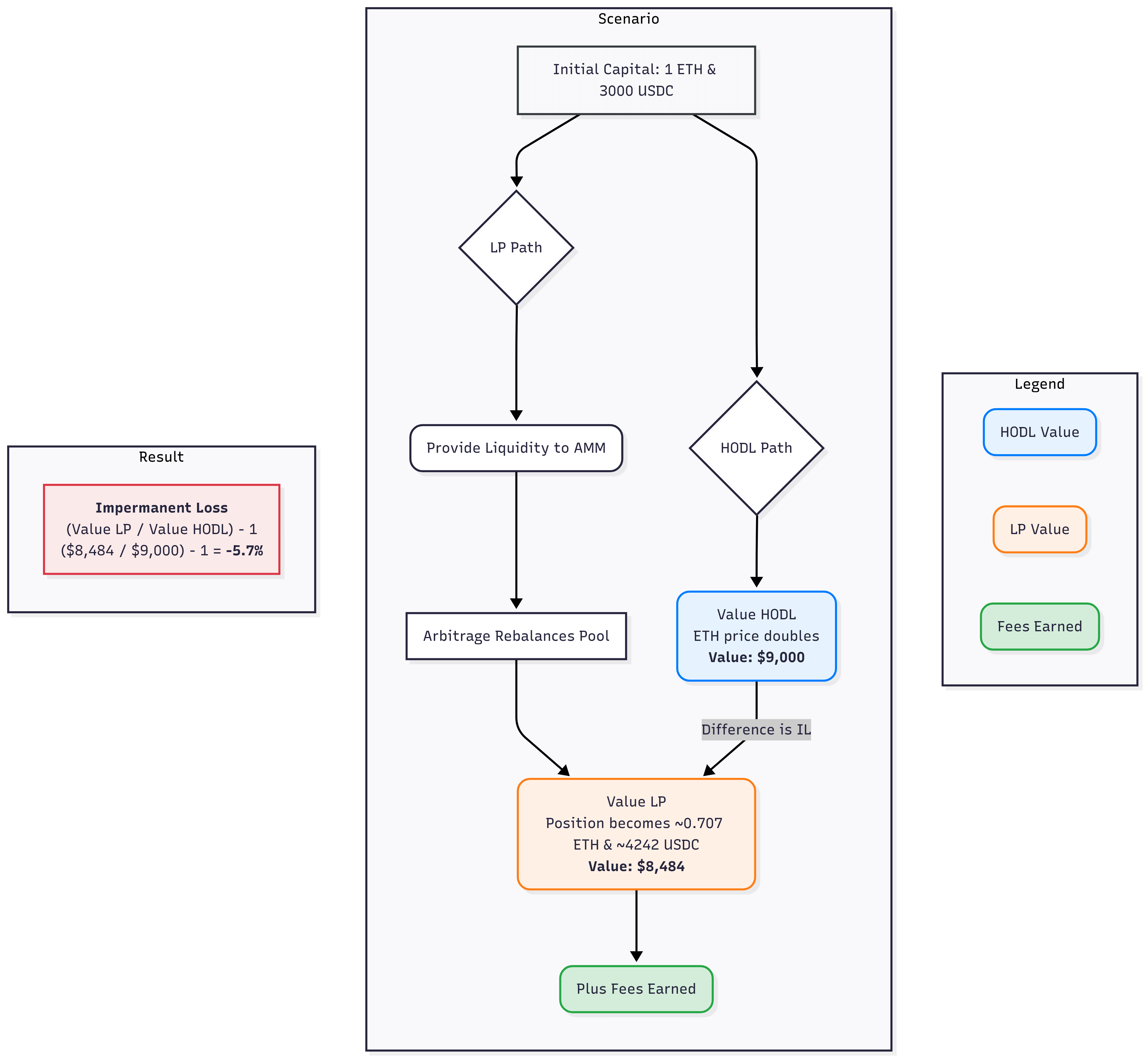

Real-World Example

You deposit 1 ETH ($3,000) and 3,000 USDC into a Uniswap pool:

Scenario: ETH doubles to $6,000

- If you HODLed: You'd have 1 ETH ($6,000) + 3,000 USDC = $9,000

- As an LP: You'd have ~0.707 ETH ($4,242) + ~4,242 USDC = $8,484

- Impermanent Loss: $8,484/$9,000 - 1 = -5.7%

Figure: Comparing the value of providing liquidity vs simply holding assets.

Figure: Comparing the value of providing liquidity vs simply holding assets.

4. How Concentrated Liquidity (Uniswap v3) Amplifies Impermanent Loss

Uniswap v3: The Game Changer

Uniswap v3 introduced concentrated liquidity, allowing LPs to focus their capital within specific price ranges rather than across the entire price curve.

Benefits:

- Capital Efficiency: Up to 4000x more efficient than v2

- Higher Fee Generation: More fees per unit of capital

- Active Management: LPs can follow price movements

Risks:

- Amplified IL: Within the range, IL is magnified

- Out-of-Range Risk: If price moves outside your range, you're 100% exposed to one asset

- Professional Discipline: Requires active monitoring and rebalancing

Empirical Reality Check

Research by Bancor and IntoTheBlock found that over 51% of Uniswap v3 LPs were unprofitable due to impermanent losses exceeding their fee income. This transforms liquidity provision from a passive activity into a professional market-making discipline.

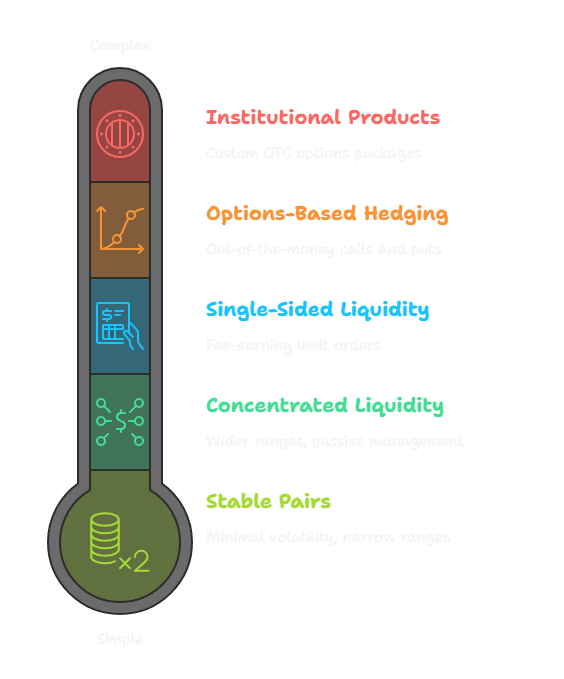

5. Strategies to Mitigate Impermanent Loss

5.1 Choose the Right Pairs

Stable Pairs (Low IL Risk):

- USDC/DAI, USDC/USDT

- Very low volatility = minimal IL

- Can use extremely narrow ranges in v3

Volatile Pairs (High IL Risk):

- ETH/altcoins, meme tokens

- High volatility = significant IL risk

- Requires higher fees to offset losses

5.2 Concentrated Liquidity Strategies

For Stable Pairs:

- Use narrow ranges (e.g., $0.999-$1.001 for USDC/DAI)

- Maximize capital efficiency and fee capture

- Minimal risk of going out of range

For Volatile Pairs:

- Use wider ranges to reduce rebalancing frequency

- Trade some efficiency for passive management

- Consider multiple ranges to spread risk

5.3 Single-Sided Liquidity (Range Orders)

One of the most powerful v3 features is single-sided liquidity:

How it works:

- Set a price range entirely above or below current price

- Only deposit one asset (the "cheap" one)

- Earn fees while waiting for your "limit order" to fill

Developer Tip: This is similar to placing a limit order on a traditional exchange, but you earn fees while waiting for your order to fill. It's a fee-earning limit order, unique to AMMs like Uniswap v3.

Example: You want to buy ETH below $2,900

- Create a range from $2,800-$2,900

- Deposit only USDC

- If ETH falls into your range, you gradually acquire ETH while earning fees

5.4 Options-Based Hedging

For sophisticated LPs, options can provide IL protection:

Long Strangle Strategy:

- Buy out-of-the-money call and put options

- Profits from large price movements (opposite of IL)

- Costs premium but limits downside

Multi-Leg Structures:

- Custom options portfolios designed to mirror IL curve

- More precise hedging but requires expertise

- Used by institutional DeFi firms

Advanced: Professional LPs and institutions often use multi-leg options strategies (combining multiple calls and puts at different strikes) to closely hedge the IL curve. These can be more cost-effective and precise than simple strangles.

Institutional IL-Hedged Products:

- Some firms (e.g., MEV Capital, OrBit Markets) offer institutional-grade products that fully hedge IL for LPs using custom OTC options packages. These are typically for large positions and may trade some upside for full downside protection.

Figure: Key strategies to reduce or hedge impermanent loss risk.

Figure: Key strategies to reduce or hedge impermanent loss risk.

6. Calculating Your Risk: A Framework

Risk Assessment Scorecard

| Factor | Low Risk (1) | Medium Risk (3) | High Risk (5) |

|---|---|---|---|

| Asset Volatility | Stable pairs | Major tokens | Altcoins/memes |

| Correlation | High correlation | Moderate | Low/negative |

| Fee/IL Ratio | >2x | 1-2x | <1x |

| Management | Passive | Semi-active | Professional |

When to Provide Liquidity

Good Candidates:

- High-fee pools with stable assets

- Pairs you're long-term bullish on both assets

- When you can actively manage concentrated positions

Avoid:

- Low-fee pools with volatile assets

- Pairs where you expect one asset to significantly outperform

- If you can't monitor and rebalance regularly

Pro Tip: For advanced risk management, consider using implied volatility (from options markets) and asset correlation data. Higher volatility and lower correlation between assets increase IL risk. Combine these with fee projections for a more robust risk model.

7. Weighted Pools: Reducing IL with Custom Ratios

Not all AMMs require a 50/50 split between assets. Protocols like Balancer allow for weighted pools (e.g., 80/20, 60/40). By overweighting a more stable or preferred asset, you can reduce your exposure to IL from the more volatile asset. This is a powerful tool for risk management and portfolio construction.

- Example: In an 80% WETH / 20% COMP pool, your position is less sensitive to COMP price swings than in a 50/50 pool.

- Tradeoff: If your overweighted asset underperforms, losses can be amplified.

- Formula: The IL formula changes for non-50/50 pools. See Balancer's docs for details.

8. Impermanent Loss Calculator: A Solidity Code Example

Here's a simple Solidity function to calculate impermanent loss:

function calculateImpermanentLoss(uint256 initialPrice, uint256 currentPrice)

public pure returns (int256 lossPercentage) {

// Convert to basis points for precision

uint256 priceRatio = (currentPrice * 10000) / initialPrice;

// Calculate IL using the formula: 2*sqrt(d)/(1+d) - 1

uint256 sqrtPriceRatio = sqrt(priceRatio);

uint256 numerator = 2 * sqrtPriceRatio;

uint256 denominator = 10000 + priceRatio;

// Calculate percentage (in basis points)

uint256 ilBasisPoints = (numerator * 10000) / denominator;

// Convert to percentage (negative for loss)

lossPercentage = int256(ilBasisPoints) - 10000;

}

function sqrt(uint256 x) internal pure returns (uint256) {

if (x == 0) return 0;

uint256 z = (x + 1) / 2;

uint256 y = x;

while (z < y) {

y = z;

z = (x / z + z) / 2;

}

return y;

}

9. The Future of IL Management and Account Abstraction (ERC-4337 & ERC-7702)

The evolution of Ethereum's account structure is set to revolutionize how liquidity providers manage risk. While many of the strategies discussed, like active rebalancing and options hedging, have been possible for sophisticated users, account abstraction is making them more accessible, automated, and affordable for everyone.

Emerging Solutions

- Dynamic Fee Models: Protocols that automatically adjust LP fees based on real-time market volatility, ensuring that fees earned are more likely to compensate for potential impermanent loss.

- IL-Protected Products: The rise of decentralized insurance protocols and structured products that offer built-in hedging against impermanent loss, allowing users to deposit liquidity with a safety net.

- Advanced Analytics: A new generation of tools that provide real-time IL monitoring, predictive analytics for fee income, and AI-driven recommendations for setting optimal concentrated liquidity ranges.

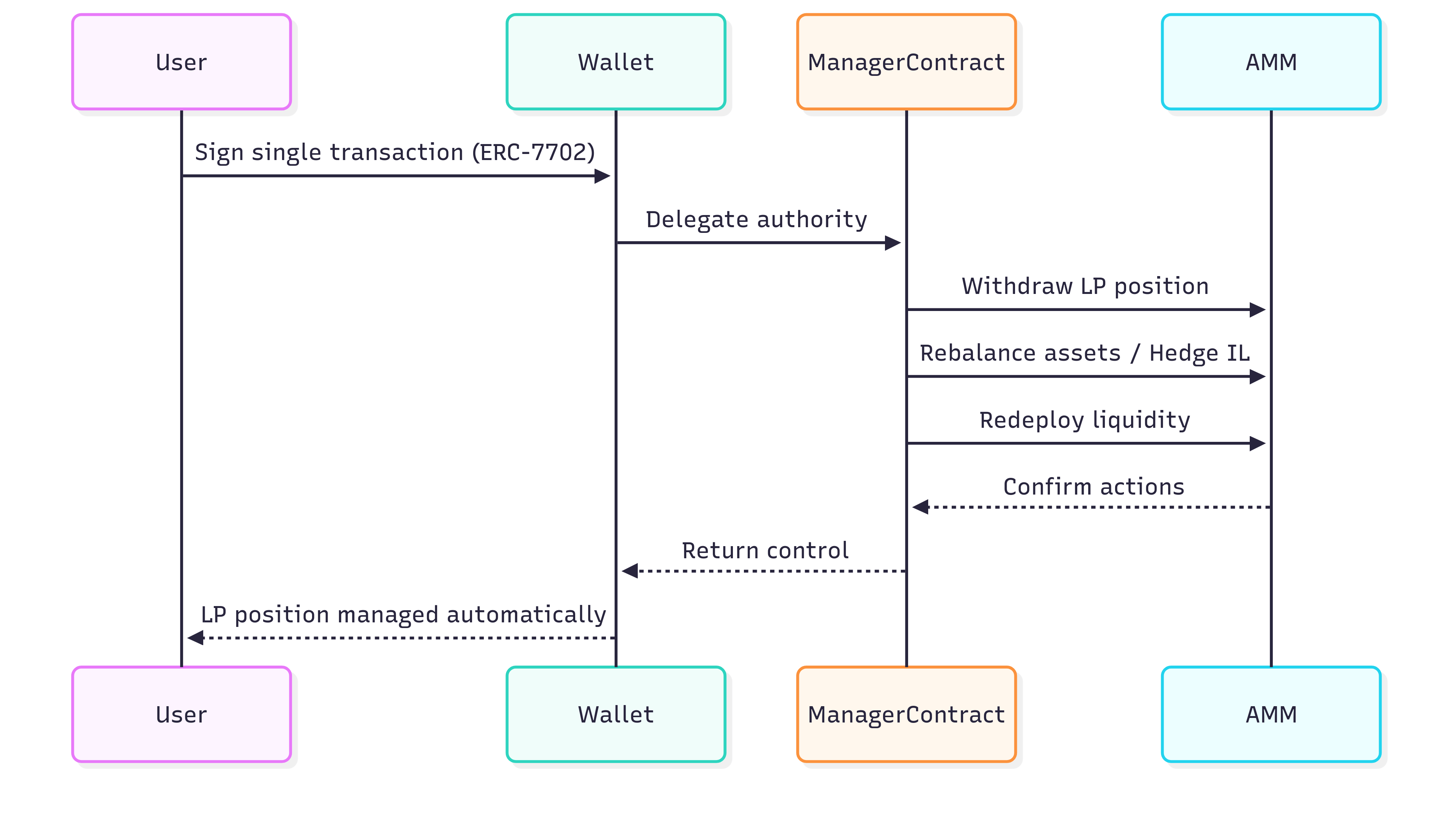

Account Abstraction's Impact: From Manual Actions to Automated Strategies

The combination of two key standards, ERC-4337 and the newer ERC-7702, represents the state of the art in account abstraction and is a game-changer for IL management.

-

ERC-4337: The Foundation for Smart Wallets ERC-4337 laid the groundwork by creating a separate infrastructure for "smart contract wallets." This standard allows for features like gas sponsorship (where dApps can pay user fees), transaction batching, and social recovery. Its main focus is on onboarding new users to dedicated smart accounts that possess these advanced capabilities from day one.

-

ERC-7702: Upgrading Existing Wallets The limitation of ERC-4337 is that its benefits are primarily for new smart wallets, not the hundreds of millions of existing user wallets (Externally Owned Accounts or EOAs). ERC-7702 brilliantly solves this. It's a protocol-level upgrade that allows a standard EOA to temporarily delegate its authority to a smart contract for a single transaction.

In simple terms, ERC-7702 lets your regular wallet act like a powerful smart wallet on demand, without needing to migrate your assets.

What This Unlocks for Impermanent Loss Management:

With these two standards working together, a new era of automated and user-friendly IL management is possible:

-

One-Click Rebalancing: A Uniswap v3 LP using a standard MetaMask wallet could, with a single signature, authorize a trusted "manager" contract to perform a complex rebalancing of their position. The manager contract would atomically withdraw the liquidity, swap the assets to the correct ratio, and redeposit them into a new price range. All in one seamless, "gasless" transaction (paid for by the dApp via a paymaster).

-

Automated Hedging: A user could authorize a DeFi protocol to automatically execute an options-based hedge if their position's impermanent loss exceeds a certain threshold. This "if-this-then-that" logic, previously complex and gas-intensive, becomes a single, delegatable action thanks to ERC-7702.

-

Programmatic Limit Orders & Range Management: The single-sided liquidity strategy mentioned earlier becomes far more powerful. A user can authorize a protocol to automatically "walk" their liquidity range up or down the price curve, continuously earning fees without manual intervention. This turns a static LP position into a dynamic, fee-earning strategy that adapts to the market.

By removing the friction of multiple transactions and the barrier of gas fees, account abstraction will transform liquidity provision from a high-maintenance, professional activity into a more accessible and manageable strategy for a much broader audience.

Figure: How Account Abstraction (ERC-7702) enable automated impermanent loss management.

Figure: How Account Abstraction (ERC-7702) enable automated impermanent loss management.

10. Impermanent Loss Recap:

Impermanent loss is not a bug but a feature of decentralized market making. Understanding its mathematics and mechanics is essential for any DeFi participant.

Key Takeaways:

- IL is an opportunity cost, not a direct loss

- The formula is elegant:

IL = 2√d/(1+d) - 1 - Concentrated liquidity amplifies both rewards and risks

- Active management and strategic pair selection are crucial

- Options hedging can protect against extreme IL

For Developers:

- Build IL calculators into your dApps

- Educate users about the risks

- Consider IL protection features

For Users:

- Start with stable pairs

- Understand the math before providing liquidity

- Monitor your positions regularly

- Consider hedging strategies for large positions

Impermanent loss doesn't have to be a barrier to DeFi participation, it's a risk that can be understood, calculated, and managed with the right knowledge and tools.

Ready to practice? Try the Minimum Viable Exchange (Dex) Challenge!

Want to build with tokens? Try the Token Vendor Challenge!