ERC4626 Vaults: Secure Design, Risks & Best Practices

TL;DR:

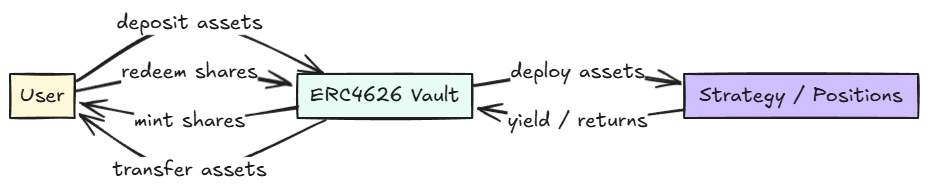

- ERC4626 standardizes tokenized vaults: deposit assets, mint shares, then redeem shares for assets.

- Security hinges on

totalAssets(): it drives pricing forconvertToShares/convertToAssets. - Top risks: first-depositor inflation, reentrancy, fee-on-transfer/rebasing tokens, oracle manipulation, rounding drift.

- Custom features (fees, caps, queues, RBAC) add complexity. Design cautiously, test heavily.

- Build with audited libs, implement Checks-Effects-Interactions(CEI) + reentrancy guards (see OpenZeppelin ReentrancyGuard), and write invariants/fuzz tests.

1. What Is ERC4626?

ERC4626 (Tokenized Vault Standard) unifies how vaults issue transferable “shares” representing a proportional claim on underlying assets. This makes integrations easier across DeFi.

Core interface highlights:

asset(): underlying token addresstotalAssets(): total managed assetsconvertToShares(assets)/convertToAssets(shares)deposit,mint,withdraw,redeem

For an audited reference implementation and deeper guidance, see the OpenZeppelin ERC4626 documentation.

Tip: In most vaults, the share price is implicitly

totalAssets() / totalSupply(). Precision and rounding rules matter.

Figure: ERC4626 flow: deposit assets to mint shares, redeem shares to withdraw assets, and strategies feed yield back to the vault.

2. Why totalAssets() Is Critical

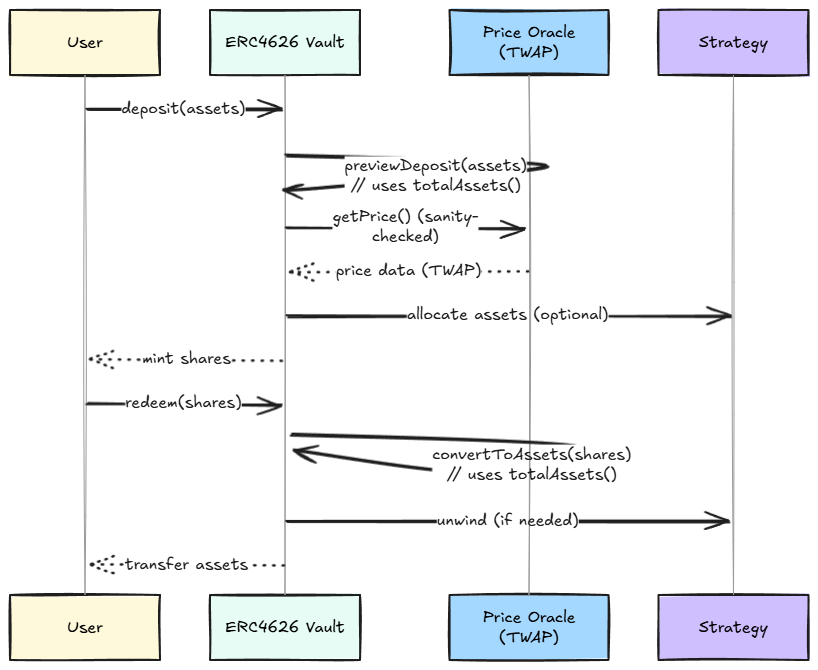

All pricing flows through totalAssets(). If it’s wrong or manipulable, convertToShares/convertToAssets will misprice deposits and redemptions.

Common pitfalls:

- Treating

totalAssets()as simplyasset.balanceOf(address(this))when assets can be sent directly or deployed into strategies. - Ignoring strategy PnL, fees, or pending accruals.

- Relying on fragile oracles for complex positions (e.g., LP tokens).

Best practices:

- Include only assets truly attributable to shareholders.

- Carefully reconcile direct transfers and strategy balances.

- If using oracles, add sanity checks, TWAPs, and circuit breakers.

Figure: totalAssets() drives conversions, and oracle reads should be sanity-checked and resistant to manipulation.

3. Common ERC4626 Vulnerabilities (and Fixes)

| Vulnerability | Attack Vector | Impact | Mitigations |

|---|---|---|---|

| Share Price Manipulation | First depositor mints 1 share, then sends large assets directly | Subsequent users get tiny shares and the attacker exits with most assets | Seed with non-trivial liquidity, use virtual shares/assets, require a minimum deposit, and make totalAssets() robust |

| Direct Transfers to Vault | Assets sent to vault address outside deposit() | Skews totalAssets() and share pricing if not reconciled | Reconcile external transfers, ignore unsolicited assets, or handle them with controlled accounting |

| Reentrancy | ERC777 hooks or external calls inside hooks | State corruption, theft | Follow CEI and nonReentrant, and minimize or guard external calls |

| Hook-based Reentrancy | Custom beforeWithdraw/afterDeposit hooks call out | Cross-function reentry into sensitive logic | Avoid external calls in hooks, or guard hook paths with nonReentrant and strict CEI |

| Non-standard Assets | Fee-on-transfer or rebasing tokens | Price drift, accounting mismatches | Use actual-received amounts, adapt math to rebasing, and prefer wrapped tokens or disallow incompatible assets |

| Oracle Manipulation | Spot price manipulation or downtime | Cheap mints / expensive redemptions | Use decentralized oracles, TWAPs, deviation checks, and circuit breakers |

| Rounding & Precision | Integer division in conversions | Dust accumulation, unfairness | Multiply before divide, use conservative rounding, and add fuzz tests |

| DoS & Gas | Complex strategies in deposit/withdraw | TX failures under load | Optimize strategies, isolate heavy operations, and profile gas |

| Malicious Token Behavior | Tokens revert/blacklist on transfer/transferFrom | Deposits/withdrawals can brick | Vet assets, use SafeERC20, and allow admins to disable or unwrap problematic tokens |

| MEV Timing / Front-running | Front-running deposits before a large, profitable harvest() and back-running withdrawals immediately after | Attacker captures yield without long-term risk, diluting returns for legitimate LPs | Smooth accruals over time, use private transactions for harvests (for example, Flashbots), and consider short-term withdrawal lockups or fees |

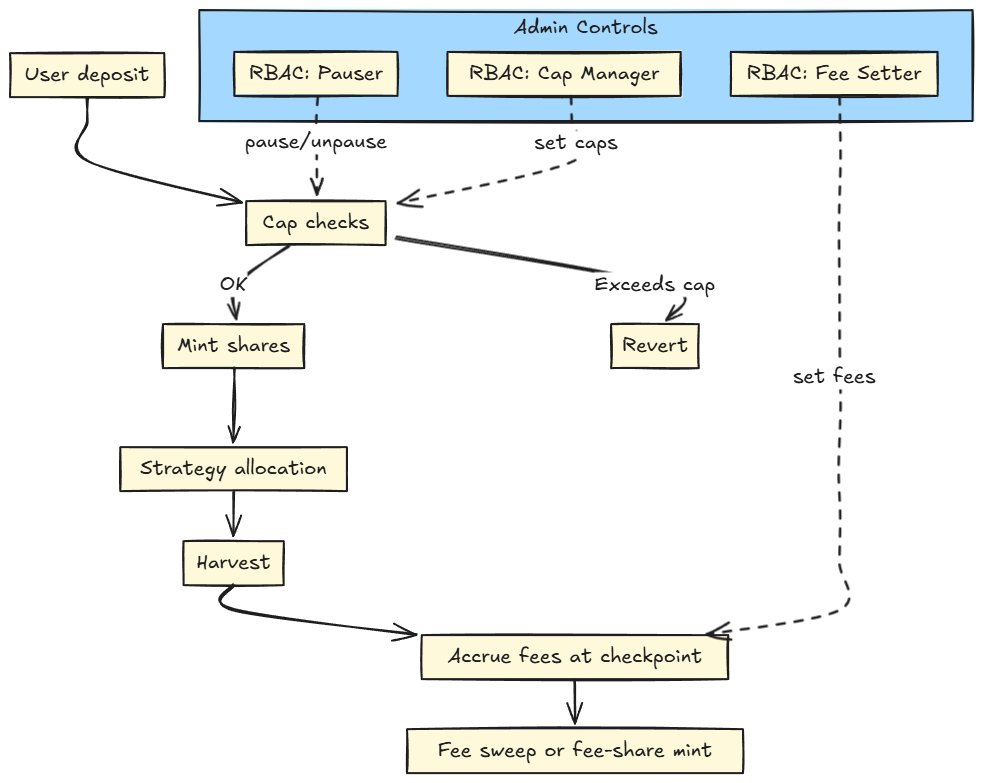

4. Secure Customization Patterns

- Fees (management/performance/exit): Accrue at harvest/checkpoints and sweep to a fee recipient, or mint fee shares strictly against realized gains to avoid ongoing price distortion. Keep pricing deterministic for users.

- Caps (global/per-user): Use checks in

deposit/mintto throttle TVL or user concentration. - Withdrawal Queues/Gates: Model FIFO requests for illiquid strategies. Enforce fairness and anti-gaming (e.g., per-address caps, snapshots). Reflect gating in

maxRedeemand previews. - RBAC: Protect all admin functions (fees, caps, strategies, pausing) using

AccessControland multisigs. Consider timelocks. - Pause/Circuit Breakers: Add pausable paths and emergency stops if oracles fail or strategies misbehave.

Figure: Customization flow with caps, fee accrual and sweep, and RBAC controls.

5. Solidity Example: Guarded Deposit/Withdraw Skeleton

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.20;

import "@openzeppelin/contracts/security/ReentrancyGuard.sol";

import "@openzeppelin/contracts/token/ERC20/IERC20.sol";

// import "./ERC4626.sol"; // Your base implementation (e.g., Solmate/OZ style)

interface IERC4626Minimal {

function asset() external view returns (address);

function previewDeposit(uint256 assets) external view returns (uint256 shares);

function previewWithdraw(uint256 assets) external view returns (uint256 shares);

function totalAssets() external view returns (uint256);

}

contract SecureVault is ReentrancyGuard {

IERC4626Minimal public immutable vault; // wrap/extend your base ERC4626

IERC20 public immutable underlying;

// Custom errors for gas-efficient reverts

error ZeroAssets();

error ZeroShares();

error TransferInFailed();

error TransferOutFailed();

constructor(IERC4626Minimal _vault) {

vault = _vault;

underlying = IERC20(_vault.asset());

}

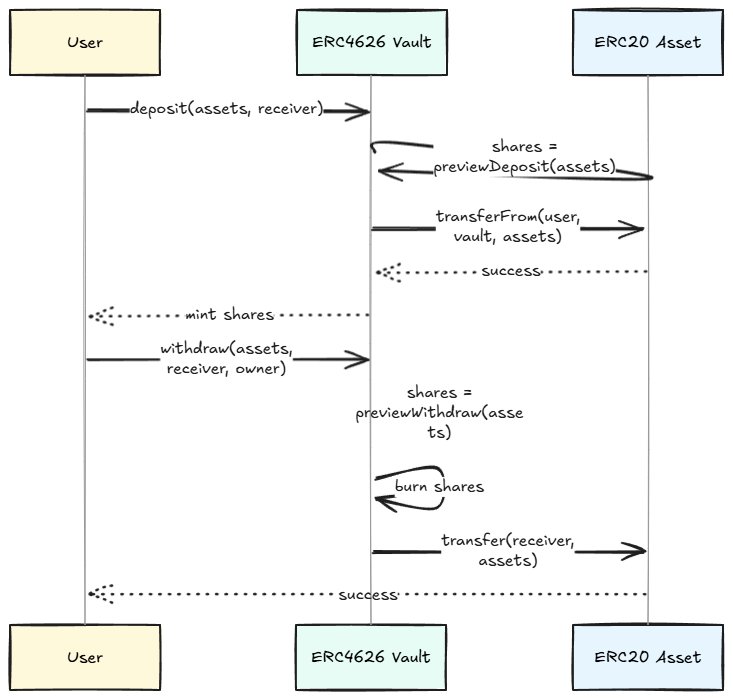

function deposit(uint256 assets, address receiver) external nonReentrant returns (uint256 shares) {

if (assets == 0) revert ZeroAssets();

shares = vault.previewDeposit(assets);

if (shares == 0) revert ZeroShares();

// Pull tokens AFTER computing shares; follow CEI

bool ok = underlying.transferFrom(msg.sender, address(this), assets);

if (!ok) revert TransferInFailed();

// Forward to underlying vault or perform accounting, then mint shares (in your ERC4626 impl)

return shares;

}

function withdraw(uint256 assets, address receiver, address owner) external nonReentrant returns (uint256 shares) {

if (assets == 0) revert ZeroAssets();

shares = vault.previewWithdraw(assets);

// Burn shares and push assets out in your ERC4626 impl

bool ok = underlying.transfer(receiver, assets);

if (!ok) revert TransferOutFailed();

return shares;

}

}

Note: Treat this as a skeleton for CEI +

nonReentrantflow and preview-based pricing. Build atop a well-audited ERC4626 base.

Figure: CEI + nonReentrant skeleton: previews drive pricing, and token transfers occur after state calculations.

Optional: RBAC and Simple Fee Handling (Illustrative)

// Role example (names vary by project)

import "@openzeppelin/contracts/access/AccessControl.sol";

bytes32 constant PAUSER_ROLE = keccak256("PAUSER_ROLE");

bytes32 constant FEE_SETTER_ROLE = keccak256("FEE_SETTER_ROLE");

contract Roles is AccessControl {

constructor(address admin) {

_grantRole(DEFAULT_ADMIN_ROLE, admin);

_grantRole(PAUSER_ROLE, admin);

_grantRole(FEE_SETTER_ROLE, admin);

}

}

Optional pattern: accrue fees when gains are realized (for example, after

harvest), and base fees on realized PnL only.

// Inside your ERC4626 vault (sketch)

uint256 public feeBps; // basis points, e.g. 100 = 1%

address public feeRecipient;

function _accrueFees(uint256 realizedGainAssets) internal {

uint256 feeAssets = (realizedGainAssets * feeBps) / 10_000;

if (feeAssets == 0) return;

// Option A: mint fee shares against the gain

uint256 feeShares = previewDeposit(feeAssets);

_mint(feeRecipient, feeShares);

// Option B: alternatively transfer assets to feeRecipient after harvest

// IERC20 token = IERC20(asset()); // ERC4626 underlying asset

// bool ok = token.transfer(feeRecipient, feeAssets);

// if (!ok) revert TransferOutFailed();

}

6. Testing Playbook: Invariants, Fuzzing, Integrations

- Unit tests: Exercise all conversions and edge cases (zero, tiny, max values; varying decimals).

- Fuzz tests: Randomize deposit/withdraw sequences, asset behavior (fee-on-transfer, rebasing), and rounding.

- Invariant tests: Examples:

convertToAssets(convertToShares(x)) ~= x;sum(userShares) == totalSupply;totalAssetstracks balances + strategies. - Integration tests: Simulate strategies, oracle reads, and emergency paths (pauses, caps, queues).

- Auditor Focus: Verify

totalAssets()correctness, share-price manipulation resistance, reentrancy protections, RBAC on all admin, and fee accounting. - Formal Verification (advanced): Consider proving invariants for

totalAssets()and conversion functions on critical deployments.

7. Best Practices Checklist

- Use audited libraries (Solmate, OpenZeppelin). See OZ ERC4626.sol and the OZ ERC4626 docs

- Initialize fairly (seed liquidity or virtual shares)

- Follow CEI and add

nonReentrant - Handle non-standard tokens (actual received; rebasing math)

- Harden

totalAssets()(no easy manipulation; oracle sanity) - Rounding discipline (favor vault; multiply then divide)

- Admin safety (RBAC + multisig + timelocks)

- Comprehensive tests (unit, fuzz, invariants, integration)

- Use

SafeERC20for transfers (from OpenZeppelin SafeERC20) and validate return values consistently - Follow EIP-4626 rounding guidance (conservative rounding that favors the vault)

8) Related Guides & Next Steps

- Learn secure token approvals: ERC20 Approve Pattern

- Master cross-contract calls: Solidity Contract-to-Contract Interactions

- Understand LP risks: Impermanent Loss Explained

- Build tokens first: How to Create an ERC20 Token

Ready to practice? Try the Crowdfunding Challenge in Speedrun Ethereum.